FundNow Integration

FundNow allows users to advance funds from their accounts receivable by financing outstanding invoices.

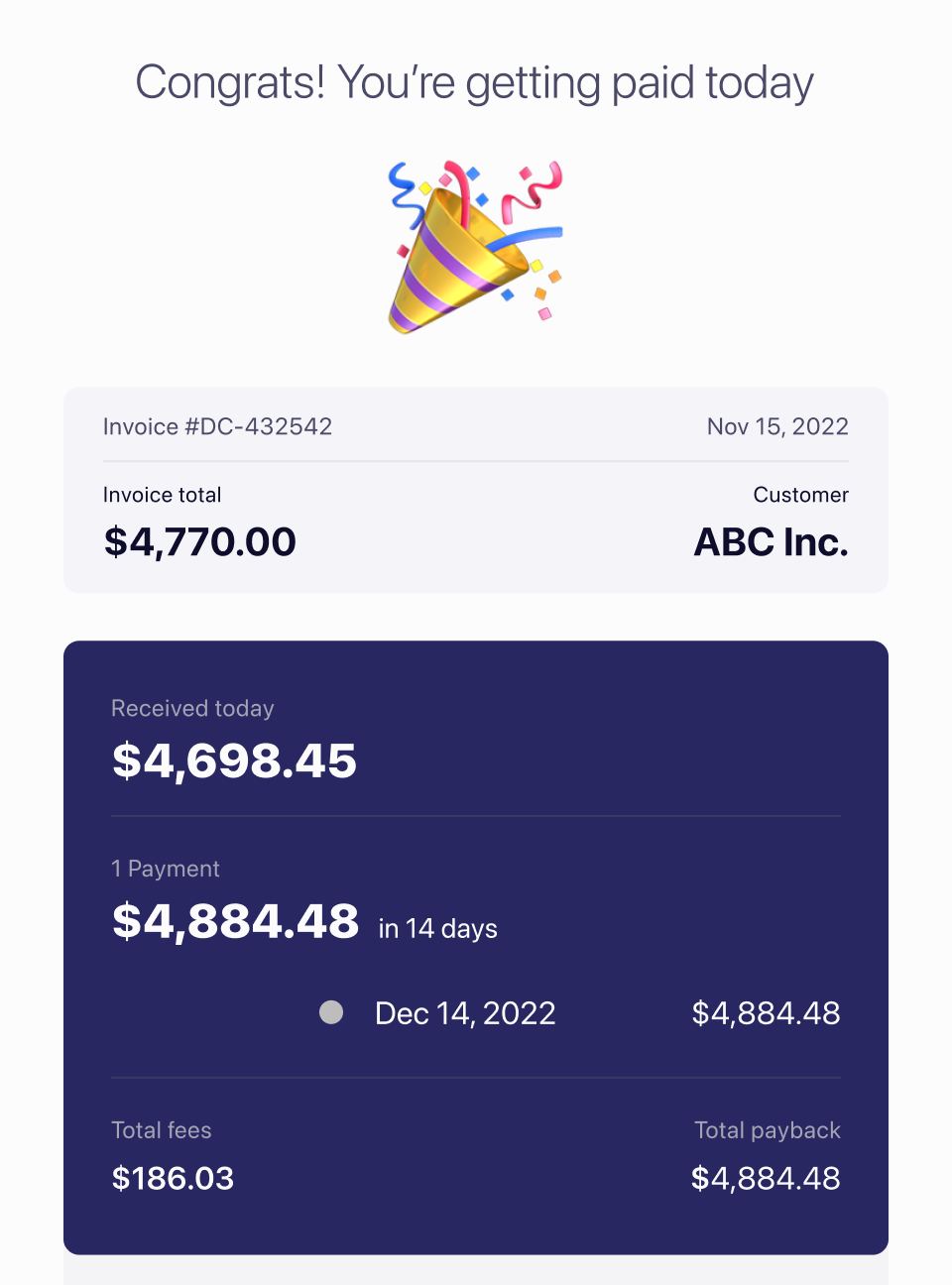

When the FundNow button is installed properly, clicking it should open a screen like this.

Step 1: Frontend Preview Mode

After completing the frontend integration, users can see preview offers for FundNow based on the invoice total passed into the component. These are sample values and not live offers.

Use this code to open FundNow on an invoice:

lendica.ibranch.openFundNow(

(partner_invoice_uuid = "I0001"), // Replace with invoice ID

(total = 1000) // Replace with invoice total

);

Before completing the backend integration, PayLater will only display preview offers.

To activate offers based on live data from your platform, proceed with the backend integration.

Step 2: Backend Integration (Required for Live Offers)

To provide live offers based on actual invoice data, Lendica needs to integrate your API with our backend. This allows Lendica to securely retrieve and analyze the relevant invoice and company data from your system.

When Backend Integration Is Complete:

Lendica will pull real invoice details from your platform and display live, personalized offers to users, based on their actual financial data.

Please refer to the Backend Integration Overview, which provides information about the API routes and functionality that we need from you.

API Requirement

The key API route needed for complete FundNow functionality is theGET Invoice Details endpoint. This endpoint should designed to fetch invoice details from a partner's system. It will support two key functionalities:

- Retrieve Specific Invoice Details:

When a user initiates the FundNow process for a specific invoice, Lendica will call this API route with thepartner_invoice_uuidto fetch the full details of that specific invoice. - Retrieve All Invoices for a Company:

Lendica may also call this route without a specific invoice ID to fetch a list of all historical invoices associated with the company. This data is used for underwriting, allowing Lendica to assess the company’s creditworthiness and financial history.

This flexibility supports both transaction-specific operations and broader underwriting processes.